Opinion beyondbrics

Myanmar telco auction: the good and the bad

Gwen Robinson

JUNE 28 2013

The decision by Myanmar’s government to award two fiercely contested national mobile communications licenses to Qatar’s Ooredoo and Norway’s Telenor Mobile Communications on Thursday raised as many questions as answers among Yangon-based analysts – not least due to an eleventh-hour effort by the country’s parliament to block news of the winning bids.

The decision by Myanmar’s government to award two fiercely contested national mobile communications licenses to Qatar’s Ooredoo and Norway’s Telenor Mobile Communications on Thursday raised as many questions as answers among Yangon-based analysts – not least due to an eleventh-hour effort by the country’s parliament to block news of the winning bids.

At the same time, conclusion of the contest reassured a growing number of investors eyeing Myanmar that the country is capable of conducting a transparent, fair and efficient public tender.

Under decades of harsh and secretive military rule, Myanmar was known for corruption and opacity in its business dealings. The telecoms contest – the first large public tender outside the natural resources sector to include foreign companies – was widely praised by consultants and participating companies, including Sunil Bharti Mittal, head of India’s Bharti Airtel, as “world class”.

Some involved in the contest complimented Roland Berger, the independent German consultant hired by the government to draw up selection criteria and compile a shortlist of bidders for the telecoms licenses. But many said the credit should go to the government of President Thein Sein, not only for hiring the consultant and adhering to the tender’s terms but also for defeating efforts by some lawmakers to derail the process.

“This indeed appears to be a sound decision based on technical requirements and financial offers,” said Romain Caillaud, managing director of consultants Vriens & Partners in Myanmar, which did not work with either winning company. “The outcome of the tender process is an encouraging sign for foreign investors that the government wants to deliver change to its population and to break with some practices of the past. The positive effect for the country will be tremendous,” he noted.

The two winning companies were among 11 final bidders for the 15-year licenses. A third bidder, a partnership between France Télécom’s Orange and Japan’s Marubeni Communications, was named as the backup candidate if either winner failed to meet “post-selection requirements”.

The news came on Thursday as scheduled, despite a near-unanimous vote the previous day in the lower house of Myanmar’s parliament to delay the announcement until passage of a new telecommunications law.

The draft bill has not been made public but is believed to contain protectionist provisions requiring telecoms operators to have local partners. Under such requirements, neither Telenor nor Ooredoo would have been eligible for the tender. They were among five or six bidders which did not have a local partner.

In its current form, the draft bill is also understood to require operators to cooperate with military authorities to enable them to access their communications systems when required. Such provisions would be extremely awkward if unacceptable for some western companies.

Lawmakers said they expect to pass the telecoms bill in the current parliamentary session, which could last about eight weeks. But given the bill’s slow progress – it has been in parliament for about one year – the move could have added “weeks if not months” to the process, noted a parliamentary aide.

Parliament’s effort to delay the announcement – and the government’s decision to ignore the vote and finalise the winners – point to further tensions between the legislature and government, particularly with the president’s office, said some Yangon-based analysts. In the tender process for the telecoms licenses, the government clearly stated that bidders were not required to form local joint ventures.

Myo Swe, secretary of the Transport, Communication and Construction Committee and a member of the ruling USDP party, who made the proposal to delay the tender results, said that only bidders with local partners should be eligible for licenses. If winners of the new licenses were named before passage of the new law, he warned, Myanmar’s telecoms industry “risked being monopolised”.

In a pointed response to parliament’s move, Winston Set Aung, deputy minister for National Planning and Economic Development, who chairs the government panel overseeing the tender, said on Thursday that parliament was “not entitled” to delay the process. He said he would not delay announcing the tender results unless the president’s office gave such instructions. “We are not dealing with small companies but dealing with the best of the best companies in the world… our dignity can be harmed if we respond late,” he added.

Even so, the eleventh-hour stand-off highlighted concerns expressed by diplomats and investors about the increasingly complex power balance in Myanmar, particularly between executive and legislature. One western diplomat said the attempted parliamentary intervention raised questions about protectionist sentiments, future contracts and the division of powers between government and parliament, particularly concerning the legal status of licenses in the face of parliamentary opposition.

Such concerns will almost certainly extend to the next round of telecoms tenders, announced recently by the deputy minister for telecommunications, who said the government would shortly invite expressions of interest for provision of internet services and the construction of a fibre optic cable. No details have been disclosed but people close to the president’s office said terms of the new tender were under consideration.

Regardless of the parliamentary moves, however, further telecoms contracts are likely to draw international interest. In the initial phase of the just-concluded contest, nearly 100 companies expressed interest, drawn by the prospect of entering one of the world’s last untapped telecoms markets with an estimated population of at least 60m.

Digicel, the Caribbean-based mobile operator which led a three-party consortium backed by billionaire investor George Soros for the mobile tender, said on Thursday it was “disappointed” not to win a license but stressed its commitment to “exploring commercial opportunities” in Myanmar and evaluating them “on an ongoing basis”.

The Digicel consortium, which included local tycoon Serge Pun through his YSH Finance, was widely seen as a leading contender and had promised to invest $9bn to build Myanmar’s mobile telecoms network. Along with several other bidders, the consortium spent lavishly on national advertising and promotional campaigns.

Ooredoo meanwhile promised to invest $15bn – far more than any other bidder – to build 10,000 base stations and achieve mobile coverage of 90 per cent of the population within two to three years, ahead of the government’s timetable. Telenor, while it did not publicly state the amount it would spend, pledged to roll out voice and data mobile services from early next year and reach nationwide coverage within five years.

The other contenders on the shortlist of 11 were Singapore Telecommunications in partnership with local partners KBZ and M-Tel; Malaysia’s Axiata Group; Japan’s KDDI and Sumitomo Corp; Vietnam’s Viettel Group; Luxembourg’s Millicom International Cellular; a consortium led by a subsidiary of South Africa-based MTN; and India’s Bharti Airtel. A 12th bidder, a partnership of Vodafone and China Mobile, had withdrawn just ahead of the June 4 deadline for submission of final bids, saying the tender did not meet their investment criteria.

Some Bangkok-based telecoms analysts said the two mobile licenses could be worth “billions of dollars” in the longer term. Others, however, warned that key requirements such as the pace of rollout and targets for coverage would be costly and difficult to meet.

More specifically, the winning companies must launch services within nine months of obtaining their licenses and provide mobile service to 25 per cent of the population within one year. They must provide voice services across three-quarters of the country within four to five years and cellular data services across half of it. At present, mobile coverage extends to just 6 to 8 per cent of the population.

In addition, the companies must cope with problems such as lack of infrastructure and electricity. They will also have to work alongside the two state-owned telecoms companies, Yatarnapon and Myanmar Posts and Telecommunications, share their telecoms infrastructure and offer low initial subscription fees.

The two winners – both state owned, respectively by the Norwegian and Qatari governments – boast abundant experience throughout Asia: Telenor with large businesses in India, Pakistan, Thailand, Malaysia and Bangladesh, and Ooredoo in Indonesia, Laos, Pakistan, the Philippines and Singapore.

However, such challenges cast further doubt on their ability to recoup investment outlays in the short to medium term, note some critics.

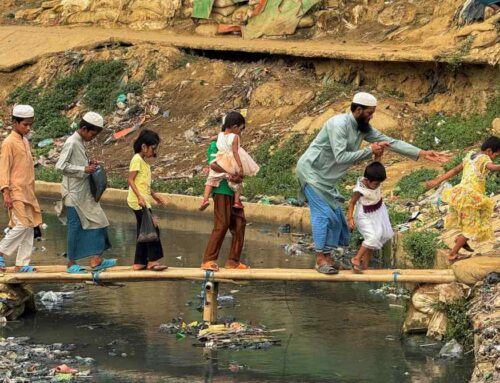

A more sensitive issue, note some diplomats, is the spread of anti-Muslim sentiment and recent outbreaks of religious violence in the country. The news that Ooredoo had won one of the telecoms licenses drew immediate criticism on Myanmar’s active social media websites, including from members of an anti-Muslim movement which has been urging boycotts of companies and products associated with Muslims.

In this respect, there is little comfort for Ooredoo in the words of U Ye Htut, a government spokesman, who told media on Thursday that religion had not been a factor in the selection. “We selected them for a license on the basis of their services — they have a good telecom service in Singapore”.

Source Link: FINANCIAL TIMES

Related reading:

Myanmar: foreign investment rush raises hopes… and concerns, beyondbrics

Myanmar: a $300bn economy by 2030, beyondbrics

Myanmar: credit card market hots up, beyondbrics

Myanmar file, beyondbrics